A Narrowing Pipeline: The Outlook On New Development For 2022 And Beyond

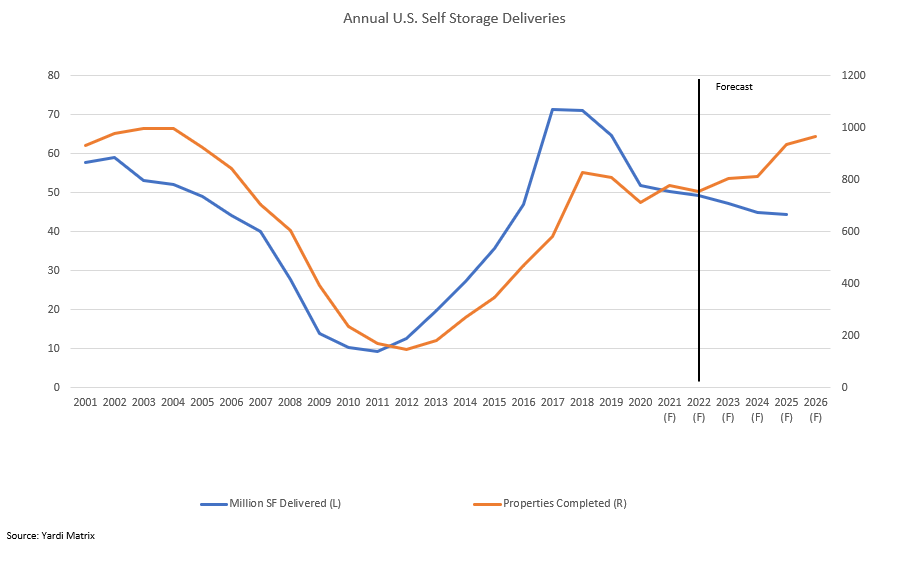

Moderation is the key word for self-storage development in 2022. After peaking in 2018 and 2019, the growth in self-storage inventory has dropped closer to the long-term average and will continue to decelerate – albeit slightly – in 2022 and beyond, according to Yardi Matrix.

Matrix forecasts 50.3 million square feet of self-storage space will be delivered in 2022, down from 51.9 million square feet in 2021. As a percentage of total stock, 2022 deliveries will amount to of 3.2%, down from 3.4% of stock added in 2021. Most of the pipeline encompasses new properties, but a growing amount will spring from conversions of other property types and expansion of existing self-storage properties.

Geographically, growth will vary widely by market, with the highest concentrations of new supply coming in rapidly growing metros such as Phoenix, Las Vegas, and Southwest Florida, or typically underserved markets that include Boston, Baltimore, New York, and New Jersey.

In the five years between 2022 and 2026, Matrix forecasts development to slow only slightly, with at least 44 million square feet developed per year. For the five-year period, our forecast expects to see deliveries of a combined 850 new self storage properties with 235 million square feet.

Pandemic Exacerbates Demand

Demand is driving the deliveries of self storage, which has been one of the best performing commercial real estate property types during the pandemic. Rent growth had been flat to negative for several years leading up to the pandemic, but demand soared, leading rents to rise sharply starting in late 2020 and through the first half of 2021. Year-over-year rent growth peaked in the summer of 2021 at 14.7% for 10X10 climate-controlled units and 12.4% for 10X10 non-climate-controlled units.

REITs and other large self storage operators reported record reaching record occupancy rates in late 2021. The weighted average occupancy of self storage REITs rose to 96.5% in the third quarter of 2021, up 200 basis points from the same period in 2020, and a 4.3 percentage point increase from the fourth quarter of 2018. Why? Well, traditional drivers of self storage demand – downsizing, divorce, death, and displacement – all contributed and in some cases were exacerbated by the pandemic. Plus the emergence of a fifth “D,” decluttering, that can be added to the list. Demand was driven by a variety of factors:

- The pandemic led people to move, creating demand for storage, for many reasons. Some of the 22 million who lost jobs during the pandemic had to move for financial reasons or to find new jobs. Some people who became free to work from home – either temporarily or permanently – decided to move from cities to suburbs, from high-cost markets to less-expensive metros, or from apartments to single-family homes.

- Operators reported a growth in short-term renters, such as households who need to store items between moves, or because of deaths, or changes in household living situations. In late 2021, the Covid-19 death toll was approaching 800,000. Some of those individuals would have died absent the virus, but the number of in the U.S. deaths has been artificially high since the spring of 2020.

- Work-from-home has helped drive self storage demand. In some cases, individuals need to store possessions to create space for a home office. The use of home offices also creates some need to store office equipment, files, and other related objects.

Many self storage operators have adapted well to meet the demand through technological solutions, such as increasing automation within facilities and implementing (or beefing up) online or contactless rental platforms. The bottom line is that storage demand generally has soared over the past two years and the drivers of that demand are likely to remain in place for the foreseeable future. In addition to driving rent growth, that has made storage development more attractive.

Phoenix Leads Development Growth

On a national level, Matrix forecasts 753 self storage properties with 50.3 million net rentable square feet (NRSF) delivered in 2022, or 3.1% less than the amount of stock delivered in 2021. Eleven metros are projected to deliver at least 1 million square feet of new stock, led by New York (3.7 million NRSF), Tampa (3.6 million NRSF) and Phoenix (2.0 million NRSF). Other metros with a large number of deliveries in 2022 include Miami (1.8 million NRSF), and Los Angeles and Dallas (1.7 million NRSF each).

New York, at 6.1%, also tops the ranking of metros in deliveries as a percentage of stock in 2022. That includes a whopping 40.9% increase in stock in Staten Island and 15.5% in Queens. Other top metros for supply as a percentage of stock are Phoenix (5.7%), Las Vegas (5.6%), San Diego and Boston (4.9% each), Minneapolis (4.7%), and Philadelphia (4.5%).

Many of the top metros in development as a percentage of stock are in the underserved markets, which illustrates the differences in penetration on a regional basis. Cities in that region are well behind markets in the rest of the country in the amount of net rentable square feet per capita (NRSF). New York’s self storage inventory amounts to about 3.5 square feet per person, roughly half the 7.0-square foot national average. Philadelphia, Boston, and New Jersey also trail the national average.

Self storage is under-supplied in NRSF in the seven U.S. gateway markets — New York, Boston, Washington D.C., Miami, Chicago, Los Angeles, and San Francisco — all of which are below the national average when it comes to inventory per capita. Every gateway market is among the top 16 metros in self-storage square feet under construction, and all but San Francisco and Chicago are above the national average in self storage development as a percentage of stock.

Yet developing self storage in gateway markets has its difficulties. The high cost of land and labor, construction and municipal fees, and high property taxes means that other property types with higher rents per foot pencil out for property owners. Plus, as demand for other types of commercial real estate such as industrial and multifamily increases, city planners may decide that they prefer a different use of scarce land resource. With demand high and inventory low, more product is needed.

Over the longer term, metros with the most development by square foot over the next five years (2022-26) are New York (13.5 million NRSF) and Dallas (11.5 million NRSF). Other metros near the top include Miami (8.4 million NRSF), Los Angeles (8.2 million NRSF), and Phoenix (7.8 million NRSF). Metros forecast to have the most self storage deliveries as a percentage of stock over the five-year period are Tampa (21.5%), Las Vegas (19.8%), Sacramento (19.5%) and New York (18.4%).

Storage development is concentrated in the hands of the five large public REITs – led by Extra Space Storage (59) and U-Haul (35) – which are projected to deliver 150 properties in 2022, or about 20% of all new properties slated to come online. After the REITs, development is primarily handled by local and regional players. Outside the top five, no other developer is expected to deliver more than four facilities in 2022.

Conversions, Expansions Rising

Just over three quarters of new supply involves new properties, but as space is increasingly scarce and raw land increasingly expensive, a growing part of the development pipeline encompasses properties that are converted from other uses or expansions of existing self storage properties. In many cases properties that are being converted are obsolete retail or industrial facilities.

Yardi Matrix tracks 73 converted properties totaling 5.8 million square feet that are expected to be delivered as self storage in 2022. That amounts to 11.5% of total new stock forecast to be delivered in 2022. Philadelphia leads in 2022 conversion deliveries, with three properties totaling 365,000 square feet, representing 4.7% of total stock, expected to be completed in 2022. Other metros with strong conversion pipelines include Memphis, Buffalo, Central New Jersey, and Cleveland.

The number of conversions is expected to rise in coming years, peaking at 179 properties totaling 15 million square feet in 2025. Measuring conversions too far into the future, however, is speculative as municipalities can change their minds about what constitutes the best use of obsolete buildings. Because of the cost of land and the vagaries of land use regulation, some developers have decided the best means of growth is to expand existing properties, which also is expected to grow significantly going forward.

Yardi Matrix tracks 150 properties totaling 5.6 million square feet of space (11.2% of all deliveries) that are slated to complete expansions in 2022. Phoenix leads metros with six expansions totaling 270,000 square feet, while Seattle has 325,000 square feet of expansions at three properties forecast to be delivered. Like conversions, expansions are projected to grow in coming years, peaking at 3.7 million square feet in more than 200 properties in 2025.

Population Shifts Drive Demand

Coming into the pandemic, self storage was seen as oversupplied in many markets, particularly in the South and Southwest. Metros such as Charleston, S.C., Dallas, Austin, Houston, San Antonio, and Nashville have net supply per person that is upwards of 50% higher than the national average. Consequently, street rates were flat to negative throughout the country in 2019 and the first part of 2020. The perception and weak fundamentals led to a softening of the future pipeline.

Yet self storage unexpectedly outperformed during the pandemic, with a surge in demand that led to rapid growth in rents, which has given new life to the forward pipeline. One of the curious and unexpected aspects to the rent surge was that the metros that were thought to be oversupplied have generally experienced the biggest bump in demand and rents. As of November 2021, street rates remained up year-over-year by at least 10% in a dozen metros, led by Atlanta (15.9%), Charlotte and Charleston, S.C. (both 14.7%), Tampa (14.1%) and Inland Empire (13.5%). Of that top dozen metros by increase in street rates, all but one – Miami – is above the national average in net supply per person.

Why metros with high penetrations of storage space performed well is no mystery. As work was untethered from offices, people were free to work and live separated from jobs and some chose to relocate to less expensive metros in the Southwest and Southeast, which also led to decades-high rent growth in multifamily properties. The question for self storage development therefore is how sustainable the resulting population shift and bump in demand is going forward. If the migration to the South and West continues and the demand surge endures post-pandemic, then the growth in highly penetrated markets is likely justified. If the demand proves to be short-lived, then new supply in highly penetrated areas may cut into occupancy rates and rent growth could once again stagnate or decline.

Rent growth has already flattened in the second half of 2021, though it’s too soon to draw firm conclusions about that. Even if the rapid gains in fundamentals return closer to historical norms in coming months, that doesn’t portend a down cycle for self storage. Demographic changes, migration, and social trends are likely to produce a fair amount of growth in demand in the future.

In any event, future development will be closely scrutinized. Some metros are saturated, while urban governments are becoming more restrictive about usage or may prefer to zone for property types such as apartment or industrial that seem more in demand now. The cost of land, construction materials and labor shortages add to the expense of development that may mean some projects do not pencil out.

The upshot is that there is a demand for self storage development, both in underserved metros and in high-supply metros that are experiencing rapid population growth and high new supply over the next few years. Just as clearly, though, the potential pitfalls and likely difficulties in getting entitlements and construction hurdles should keep supply growth at moderate levels.

More Content

Popular Posts

The REITs new pricing strategy – lowering...

The self storage industry is in a precarious...

With the approval of both companies’...

Recent Posts

Owning or managing a self-storage facility...

Helen Keller is quoted as saying, “Alone we...

It’s often been said that “opportunity is...

There’s a saying in Florida that there are...

The landscape of the self-storage industry...

Last January, the prime interest rate was...

Many of us are seeking ways to bring in new...